Best Debt Consultant in Singapore: Comprehensive Financial Solutions

Discover How Expert Financial Debt Specialist Providers Can Help You Gain Back Financial Security and Manage Your Financial Obligation Properly

In today's complicated financial landscape, numerous people locate themselves grappling with frustrating debt and uncertainty concerning their economic future. Expert financial obligation specialist solutions provide a structured strategy to restoring security, providing tailored approaches and professional insights designed to attend to distinct monetary challenges.

Recognizing Financial Obligation Specialist Solutions

Financial debt specialist services supply individuals and businesses with specialist assistance in handling and fixing monetary obligations. These solutions objective to aid clients in navigating complicated economic landscapes, providing customized techniques to address varying degrees of financial obligation. A debt consultant commonly assesses a customer's financial scenario, including earnings, expenditures, and existing debts, to create an extensive strategy that straightens with their distinct demands.

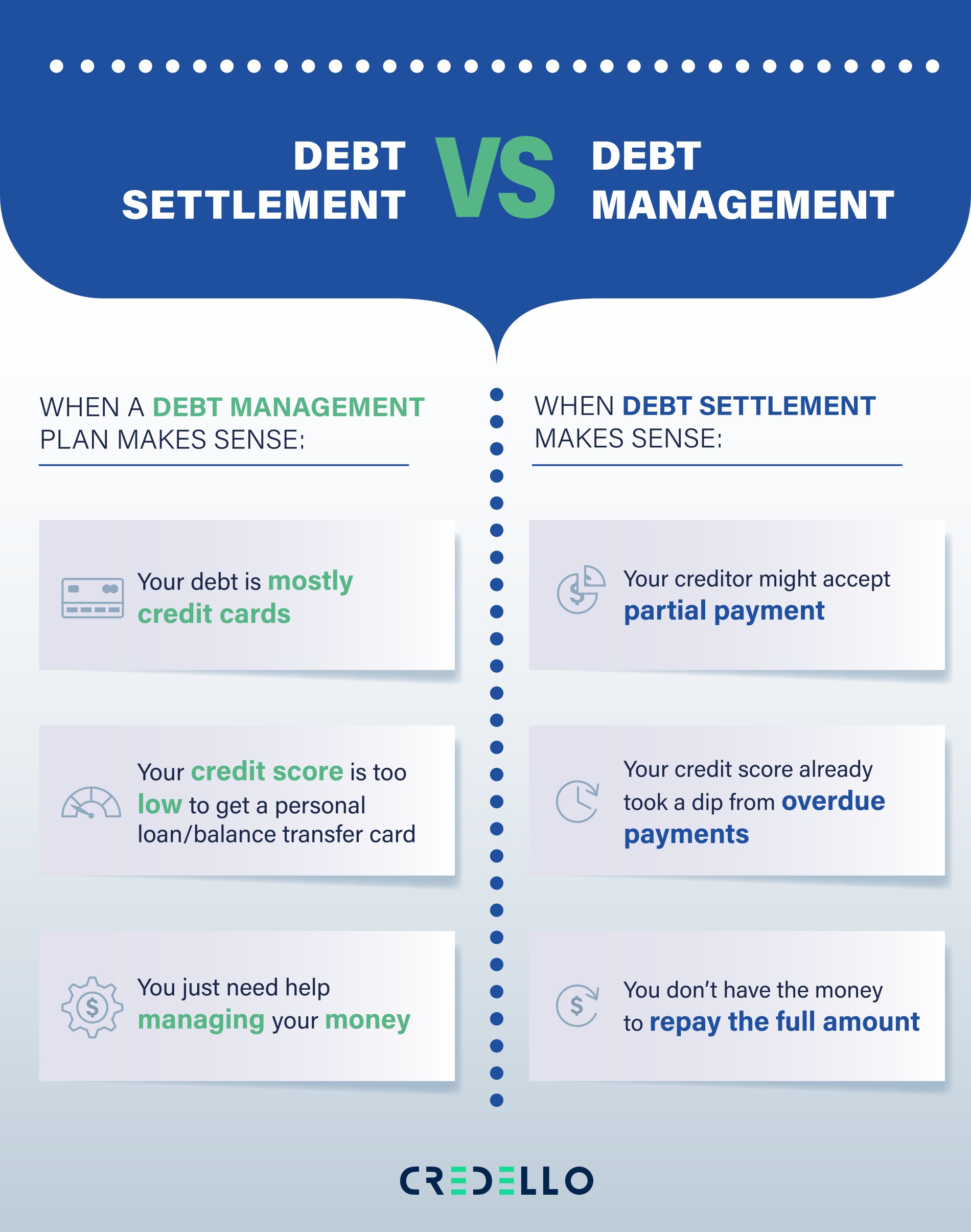

Consultants utilize a range of methods, such as budgeting aid, financial obligation loan consolidation options, and negotiation with creditors - debt consultant singapore. By leveraging their experience, they can help clients comprehend the effects of their debt, including rate of interest, repayment terms, and potential legal consequences. In addition, consultants frequently inform clients concerning economic proficiency, empowering them to make informed decisions that can result in long-lasting monetary health

In addition, these services may involve creating structured repayment plans that are manageable and sustainable. By working together carefully with clients, financial obligation experts promote a helpful setting that encourages commitment to financial discipline. Overall, recognizing the extent and features of debt consultant solutions is critical for businesses and people looking for efficient services to their financial difficulties, eventually paving the way to higher financial stability.

Benefits of Professional Assistance

Professional assistance in debt management supplies many advantages that can considerably enhance a person's or company's financial scenario. One of the primary advantages is access to expert expertise and experience. Financial obligation specialists have a deep understanding of different financial items, legal regulations, and market problems, enabling them to give educated advice customized to particular conditions.

In addition, financial obligation professionals can use negotiation abilities that individuals may lack. They can interact effectively with lenders, possibly protecting far better payment terms or lowered rates of interest. This advocacy can result in extra beneficial end results than individuals might attain by themselves.

Tailored Methods for Debt Administration

Reliable debt administration calls for greater than just a fundamental understanding of economic commitments; it demands methods customized to an individual's special circumstances. Everyone's monetary circumstance stands out, influenced by various aspects such as revenue, expenditures, credit report background, and individual objectives. Professional debt specialists master creating customized plans that deal with these particular aspects.

With a detailed analysis, professionals recognize one of the most important financial debts and assess investing behaviors. They can after that recommend reliable budgeting strategies that straighten with one's way of living while focusing on financial debt settlement (debt consultant singapore). Additionally, specialists check out this site may suggest combination techniques or settlement techniques with financial institutions to lower rate of interest or establish convenient settlement plans

A substantial benefit of customized techniques is the flexibility they provide. As circumstances change-- such as job loss or boosted expenditures-- these methods can be adjusted appropriately, guaranteeing continuous relevance and efficiency. Additionally, experts supply ongoing support and education and learning, empowering people to make enlightened choices in the future.

Inevitably, customized financial debt monitoring techniques not only assist in instant alleviation from monetary worries but likewise foster more info here long-lasting financial stability, allowing people to regain control over their funds and attain their monetary objectives.

Just How to Select a Specialist

How can one make certain that they select the best financial debt consultant for their demands? Selecting a financial debt expert requires careful consideration of numerous vital elements. First, analyze their credentials and experience. Look for specialists with pertinent qualifications, such as those from the National Foundation for Credit Counseling (NFCC) or the Organization of Credit Report Therapy Experts (ACCP) Their competence in taking care of financial debt remedies is critical.

Following, examine their credibility. Research study online testimonials and reviews to determine the experiences of past clients. A trusted consultant will commonly have favorable feedback and a performance history of successful financial debt monitoring end results.

It is additionally necessary to understand their strategy to financial obligation management. Arrange a consultation to review their approaches and ensure they line up with your economic goals. Openness concerning costs and solutions is vital; a trustworthy consultant needs to give a clear summary of expenses included.

Finally, think about the expert's communication style. Choose somebody who listens to your answers and concerns your questions plainly. A strong connection can promote a collaborative connection, necessary for successfully handling your debt and accomplishing monetary stability.

Actions to Attain Financial Stability

Achieving monetary security is a why not try these out methodical procedure that includes a collection of purposeful actions tailored to specific circumstances. The initial step is to analyze your current economic situation, including revenue, financial debts, assets, and costs. This extensive analysis provides a clear photo of where you stand and assists recognize locations for improvement.

Next, produce a practical spending plan that prioritizes important costs while alloting funds for financial debt repayment and savings. Sticking to this budget plan is important for keeping economic technique. Following this, discover financial debt monitoring alternatives, such as combination or negotiation, to decrease rates of interest and monthly payments.

Establish an emergency fund to cover unexpected expenses, which can prevent dependence on credit scores and further debt accumulation. Once prompt economic stress are dealt with, focus on long-term economic objectives, such as retired life cost savings or investment approaches.

Verdict

In conclusion, specialist debt specialist solutions offer useful sources for individuals seeking monetary security. By providing professional advice, tailored techniques, and recurring assistance, these specialists assist in reliable debt management.

In today's complicated economic landscape, several individuals find themselves grappling with overwhelming financial obligation and unpredictability about their financial future. Expert financial obligation expert solutions supply a structured approach to restoring stability, supplying customized methods and experienced understandings designed to address special economic obstacles. A financial debt professional typically evaluates a client's financial situation, including revenue, expenses, and existing financial debts, to create a thorough strategy that straightens with their special requirements.

Generally, comprehending the range and functions of debt consultant solutions is critical for services and individuals seeking reliable remedies to their monetary difficulties, ultimately leading the way to better economic stability.

In conclusion, expert financial debt expert solutions use important sources for individuals seeking monetary stability.